The Of Merchant Services

Wiki Article

Get This Report about Fintwist Solutions

Table of ContentsAbout Credit Card Processing FeesLittle Known Facts About First Data Merchant Services.Comdata Payment Solutions Fundamentals ExplainedFascination About Credit Card Processing FeesThe Single Strategy To Use For Online Payment SolutionsThe Ultimate Guide To Virtual TerminalLittle Known Facts About Comdata Payment Solutions.The smart Trick of Online Payment Solutions That Nobody is DiscussingThe smart Trick of Comdata Payment Solutions That Nobody is Talking About

The B2B payments room is quite crowded. Several financial institutions, fintech firms, and sector professionals provide B2B settlements platforms, and brand-new companies are getting in the room regularly. We took a look at the choices, as well as here are several of the ideal B2B repayment options: Best for: B2B businesses that buy or offer on net terms.9% processing cost (similar to what Pay, Buddy as well as Square fee for credit rating card payments). The purchaser has 60 days to pay Fundbox, interest cost-free. After 60 days, the purchaser can expand terms for up to one year, for a level once a week fee. There's likewise check out functionality with Fundbox Pay.

First Data Merchant Services Things To Know Before You Buy

Fundbox Pay's B2B services basically change the threat of the buyer not paying far from the vendor. This resembles using bank card in the consumer space. When somebody goes to a dining establishment or gets a film ticket with a charge card, the merchant earns money as soon as possible, as well as the consumer postpones repayment for a payment cycle.

The Facts About Payment Hub Revealed

Best for: B2B companies that make use of billings to bill their consumers or pay their vendors. Pay, Pal is a heavyweight in the B2B payments market. When using Pay, Friend for these repayments, you can send out a custom-made billing through e-mail to an additional organization. All they have to do is click the "pay" button, and they can pay with their Pay, Pal equilibrium, a connected checking account, or a credit report or debit card.

Not known Incorrect Statements About Credit Card Processing

Quick, Books also supplies a B2B repayment remedy that works in a similar way to Square as well as Pay, Friend.Best for: B2B customers that intend to systematize settlements with a credit card. An unique participant in the B2B repayments area is Plastiq. One reason that taking care of B2B settlements is tough is that various suppliers favor various settlement techniques. navigate here One vendor new payments platform might ask for ACH transfer, while one more asks for cord transfer.

A Biased View of Square Credit Card Processing

Best for: B2B vendors that use on the internet checkout to wholesale buyers. Trade, Gecko is an inventory and also order management company, but additionally supplies durable B2B repayments options. There's an e-invoicing item similar to Square and Pay, Chum. However, they also provide a repayment gateway for wholesale purchasers. Basically, this is similar to an on-line checkout experience for business consumers. virtual terminal.

Not known Facts About Credit Card Processing

Whichever B2B payment service you select, a lot of small company owners discover themselves on the paying end and also obtaining end. Here are some best methods when you're the purchaser: Clear your accounts payable equilibrium by paying quickly after the deal. Make use of a credit history card to pay if you require even more time to resolve the price.Utilize your favorable list of credit card processing companies payment background to discuss beneficial terms with new providers (online payment solutions). Below are some ideal methods when you're the seller: Send a billing or repayment request right after the transaction. Follow up with friendly reminders as the settlement deadline nears. Enforce due dates and also late costs to guarantee your consumers pay on time.

Unknown Facts About Square Credit Card Processing

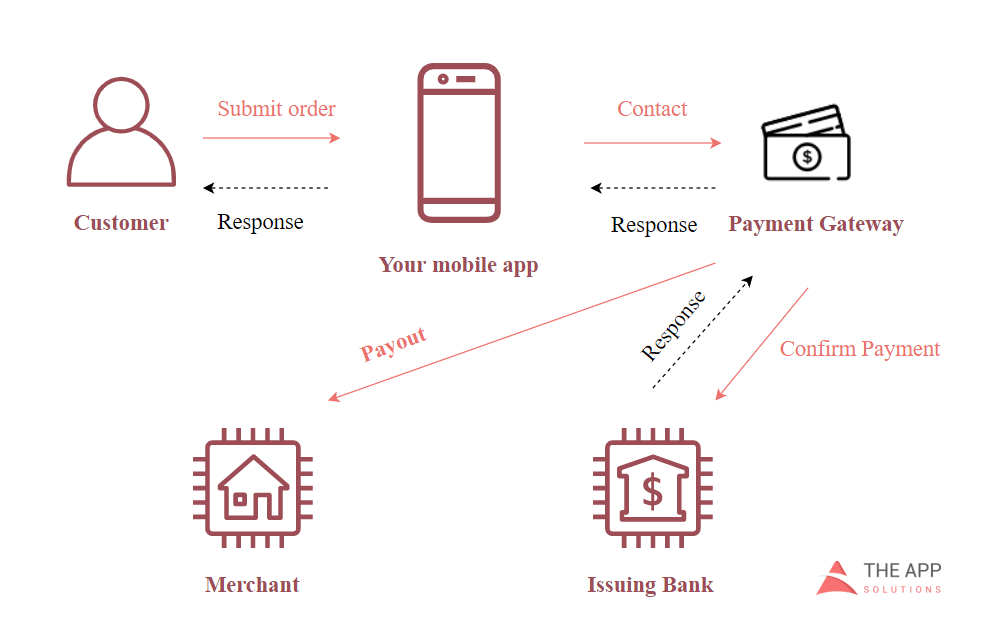

What do payment processing companies indicate when they state "settlement pile?"Basically, a settlement pile is all the parts required to develop an online payment service. There's a variety of payment methods, procedures and also stakeholders needed to produce a reliable solution for handling repayments online. This guide will assist you to understand the components of a repayment stack and also the ideas you need to understand.What are the Elements of a Payment Heap? Over the last decade, settlement modern technology has advanced beyond just allowing vendors to refine charge card. The durable collection of technologies and also capabilities that collaborate to develop modern fintech remedies are commonly described as "the payment pile."The term "repayment pile' is utilized to describe all the technologies as well as parts that a company utilizes to approve payments from clients.

Fascination About Clover Go

These are several of the components of a settlement stack that collaborate to develop a frictionless commerce experience for services, economic establishments and clients. Scams Avoidance, As technology remains to advance, illegal activity continues to progress. It should come as not a surprise that sellers and also various other companies are experiencing more data violations than ever.It's best to keep a record of every deal within the firm by using accountancy software, but also outside of the company. This is done by inspecting records with the financial institutions that tape the deals. If an error is made, just straighten your business's records with bank statements to discover the source of an error.

The Best Strategy To Use For Comdata Payment Solutions

Checkout User interface, A good checkout interface makes it very easy for customers to see prices in their regional money and to locate and use their favored neighborhood payment methods. The check out user interface is a vital part of your website experience and also vital for making sure you don't lose clients that wish to purchase from you.Report this wiki page